This analysis has been updated following federal legislative changes. Read the update here.

Please note we are unable to assist individual CERB/EI recipients with their claims. We encourage you to contact the office of your member of Parliament for assistance with your Employment Insurance file. To find your member of Parliament and their contact information, visit the Parliament of Canada website and type in your postal code.

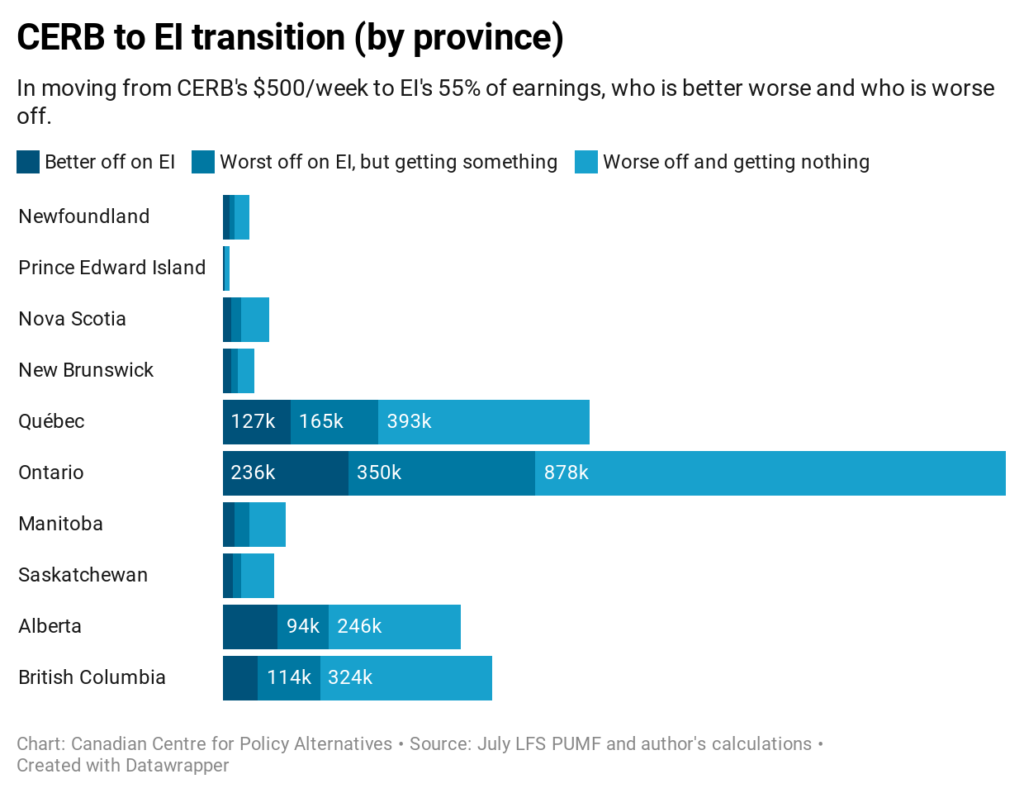

I recently looked at who could be left behind in the September rollover from the Canada Emergency Response Benefit (CERB) to employment insurance (EI). That analysis concluded that without EI modifications almost three million CERB recipients would be worse off after the switch. Of those, over two million wouldn’t be eligible for EI (and would get nothing) and another three-quarters of a million would get EI, but payments would be less than the CERB level of $500 a week. With that same dataset I wanted to examine some important regional difference and get a better understanding of how much less people could get from EI compared to the CERB.

Breaking down the CERB by province, we see that the more populous provinces of Quebec, Ontario, Alberta and British Columbia are home to the most recipients. However, 87% of CERB recipients in B.C. and 84% of recipients in Ontario will be worse off after they are rolled back into the EI program under the current rules. The counts in Ontario are truly concerning, with 1.2 million CERB recipients being worse off after they are switched to EI. Of those 1.2 million, almost 900,000 won’t be eligible for EI and will be cut off, if changes aren’t made to the program.

Many CERB recipients are EI eligible under the current rules, but after March 15 all EI recipients were rolled into the CERB program. In the rollover back to EI, these people will continue to receive income support. However, the CERB provided a flat $500 a week in benefits ($2,000 every four weeks) whereas EI is calculated at 55% of one’s previous weekly earnings. EI does not have a floor on benefits except in some rare circumstances. Without a floor on EI benefits, an unemployed Canadian can receive much less than the CERB’s $500 a week.

The chart below shows what people will receive on EI after the transition from the CERB. There are 811,000 CERB recipients who will make less on EI after the transition. On average, those people will make only $312 a week vs. CERB’s $500 a week. However, the chart shows that a quarter of a million people will make only $100 to $200 a week, more than halving what they got on CERB. Another 70,500 people will make half what they got on the CERB ($200–$300 a week). Even CERB’s $500 a week left many people struggling. It could get a lot worse as the old EI rules kick in come September.

Making this transition as seamless as possible is going to be critical for millions of jobless Canadians. To do so, rapid changes must be made to EI rules so people aren’t made worse off in the middle of a pandemic and facing the worst job market since the 1930s. In particularly, the government needs to rapidly implement the following EI rule changes taken from the AFB Recovery Plan EI chapter:

- Create a floor on benefits of $500 a week or increase the replacement rate to 75% of income for those who are EI-eligible but didn’t make much before being laid off.

- EI should move to an attestation basis for the first payment, which will help those who might not have their official layoff paperwork in order.

- EI qualifying hours should be reduced to a universal 300 over the prior year.

- EI should be altered to cover gig and self-employed workers.