Big news today that Burger King, a US company, is planning to buy Tim Horton’s, a Canadian one. This is another in a string of “tax inversion” deals where US corporations move their corporate headquarters from the US to elsewhere to avoid US taxation. They don’t actually change anything or move anyone outside of their accounting fairyland. Instead, they just check some different boxes on their income tax forms and ‘poof’ save millions in taxes.

But the loss of US taxes from BK is Canada’s benefit right? Turns out, not so much. The only reason why this particular accounting trick works is because American corporations are taxed on worldwide profits, Canadian companies (and most other countries companies) are not. What that means is that American corps pay the American government taxes on all their profits no matter which country they are made in. Canadian companies only pay the Canadian government on profits made in Canada.

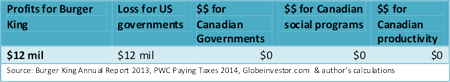

So the BK move to Canada would mean that BK will stop paying taxes on profits it makes in Kuwait to the US government. However, since no Canadian company pays taxes on profits made in Kuwait in any event, Canadian governments would bring in no additional revenues. In BK’s case, this would save them in the neighbourhood of $12 million a year in US corporate taxes. Of course, Canada sees none of that money and essentially gains nothing from this deal.

Table 1 - Estimated Annual Gains & Losses

Table 1 - Estimated Annual Gains & Losses

In the end, many corporations want to pay $0 in income taxes and have the rest of us pick up the tab for health care and infrastructure that we all benefit from. “Tax inversion” is just one of the many accounting tricks that makes regular people pick up the tab for corporations that abuse tax rules or lobby governments to pay less and less every year.

David Macdonald is a senior economist with the CCPA.