The decision to accept an offer of admission to university is a pivotal one for students; an emotional experience of high hopes, idealistic expectations and trepidation. But it also marks the first step in a series of necessary and practical preparations for any journey; deciding the best path, weighing the benefits of leaving home or staying, finding a job to save money for the road ahead, and then navigating their provincial student aid system – an adventure all its own. But regrettably, the mechanics of the student aid adventure have largely remained a mystery, where students trying to assemble sufficient financial resources must often resort to leaps of faith in uncharted territory.

The most basic way of explaining how students receive aid is with the following formula:

allowable costs - resources = assessed need

Allowable costs would include tuition, an allowance for monthly living expenses and books. Resources include a student contribution, a parental contribution and perhaps scholarships. When you subtract a student’s resources from the cost of their education, you’re left with the assessed need; the amount that federal and provincial programs consider for aid, which might come in the form of repayable (loans) or non-repayable assistance (grants). Sounds simple, right?

But for many students, this is where the real adventure begins. For the most part, the federal government (through the Canadian Student Loans Program) is responsible for 60% of that assessed need, and the province for the remaining 40% (although not all provinces participate in the federal program). Provinces can administer their portion of aid in whatever way they choose—and the differences between provincial priorities is indeed staggering. And if the complexities between provinces weren’t enough, what happens within provinces will make your head spin.

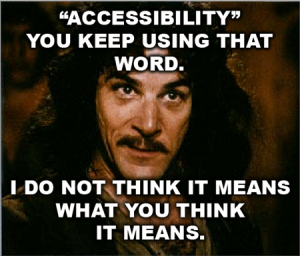

Canadian university students, welcome to the three perils of the Fire Swamp[i]: Rodents of Unusual Size (ROUS), lightning sand, and flame spurts. Not unlike the restrictive eligibility criteria set out by government student aid programs, the ROUS are exactly what you think they’d be – unappealing, aggressive creatures that can maim you in a single bite. Whether it’s because your program of study doesn’t comply with your province’s ‘labour market priorities’ (BC) or because your middle-income parents are expected to front $3,700 per year for your education (QC), it can be incredibly difficult to qualify for the resources you need to go to school. And ‘not qualifying’ can cut the legs out from beneath students who are trying to access post-secondary education.

But the ROUS are not the only threat in the Fire Swamp. Government student aid programs calculate ‘allowable costs’ based on provincial averages for rent and living allowances and their own expectations of what students ‘should’ earn in a summer, rather than on actual expenses. High youth unemployment and the exorbitant cost of living in major urban centers (which can exceed provincial averages) can mean that students find themselves caught in the lightning sand, unexpectedly swallowed up by the seemingly-reliable earth beneath them.

Even if students manage to avoid the lightning sand, the tenuous and unreliable nature of many financial aid programs is the third Fire Swamp hazard: flame spurts. From year to year, grants that students once qualified for can be modified, eliminated, combined, or replaced by a new program for which they may no longer be eligible. The unpredictability of many of these programs combined with changing government budget priorities means that students who may have successfully accessed the resources available in their province one year can get burned the next-- a peril with which Ontario students[ii] are very familiar.

All of this begs a number of questions: is the current student aid Fire Swamp the best model for providing financial refuge for students who are trying to pursue a university education? Is it meeting the needs of students, or is it promoting inequality within and between provinces within a murky, unpredictable morass? Finally--and most importantly--is this the most efficient, effective, fairest and most publicly-accountable way to ensure that all students, regardless of their location or socioeconomic status, can pursue higher education?

With the inconceivable uncertainties of student financial assistance, it's unclear whether Canadian students desperately seeking university funding will, like Princess Buttercup, emerge safe and victorious from the Fire Swamp. After all, these days--even for those in the Humanities--a giant, a swashbuckling Spaniard, and a partially resurrected pirate are resources most of us don’t encounter very often. And given the adventure ahead of them navigating a student aid system that is not only non-transparent but also inequitable and in many cases counter-intuitive, it’s clear that students need all the help they can get.

Jordan Maclaren is a student in the Masters of Social Work program at Carleton University and the author of It’s Complicated: An interprovincial comparison of student financial aid, published by the CCPA.

[i] For those of you unfamiliar with the Princess Bride, our protagonists (very much in love and pursued by an evil prince) seek safety in the Fire Swap, a place so dangerous no one who has entered has ever returned.

[ii] The 30% Off Tuition Grant is one of these programs and provides students with a fixed amount of non-repayable aid (not actually 30%, just to confuse you further) to reduce the sting of being from and going to university in the province with the highest tuition fees. But if in addition to the 30% Off Tuition Grant you also qualify for the Ontario Access Grant, the plot thickens. You may be able to receive between 25% and 50% off your actual tuition, depending on how much money your parents make, but whatever amount you get will be reduced by the 30% Off Tuition Grant. Unless your costs exceed the loan you can receive, in which case you get whichever is less, the remaining Ontario Access Grant or your remaining need.

But don’t get too comfortable: if you’re an Ontario student who just got excited about the grants you may be able to access, but you’ve been out of high school for more than four years, sorry—you are officially ineligible.